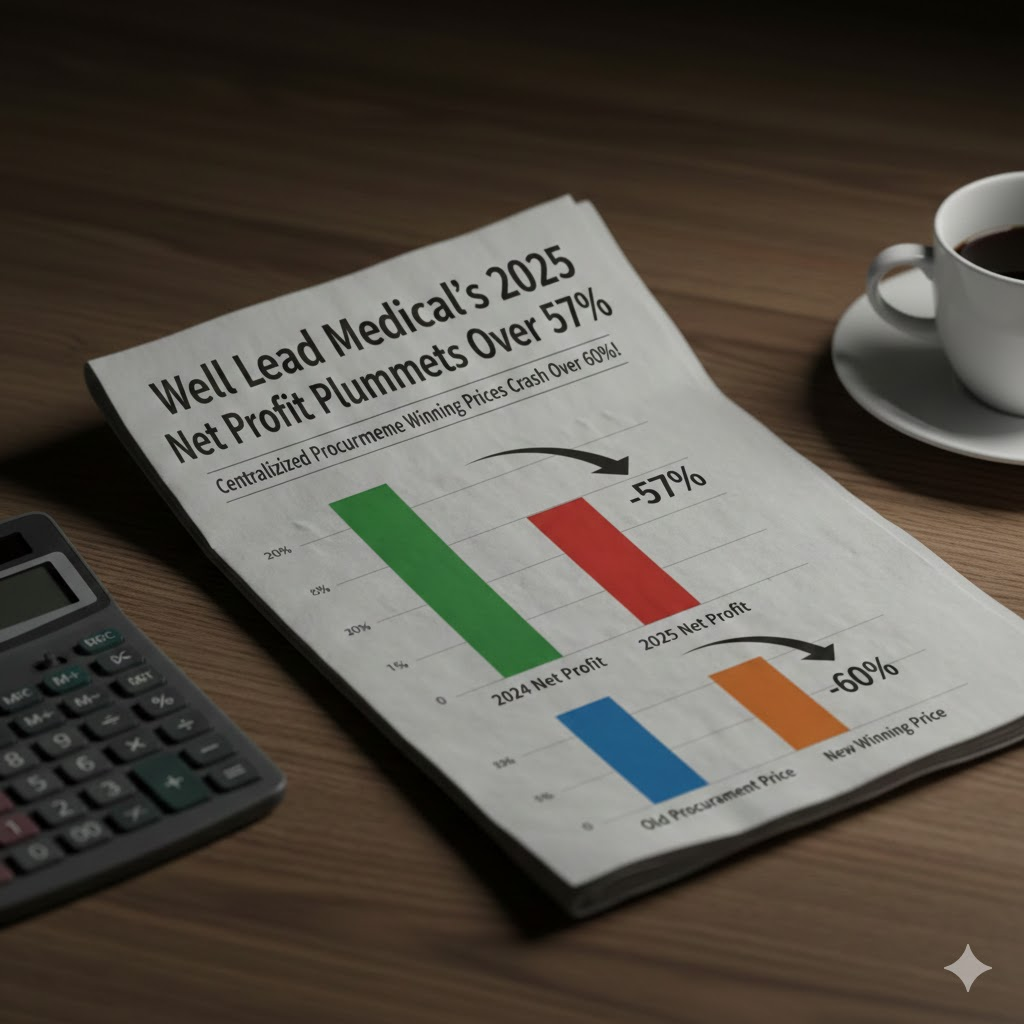

Recently, according to Well Lead Medical’s 2025 annual performance forecast, the company’s preliminary calculations by the finance department estimate that the net profit attributable to the parent company’s owners for 2025 will be between RMB 75 million and 95 million. This represents a decrease of RMB 144.39 million to RMB 124.39 million compared to the same period last year, a year-on-year decline of 66% to 57%.

The estimated net profit attributable to the parent company’s owners after deducting non-recurring gains and losses for 2025 is between RMB 65 million and 85 million. This represents a decrease of RMB 145.02 million to RMB 125.02 million compared to the same period last year, a year-on-year decline of 69% to 60%.

Regarding the reasons for the significant profit decline, the company stated that the operating performance of its wholly-owned subsidiary, Jiangxi Langhe Medical Instrument Co., Ltd. (hereinafter “Langhe Medical”), has substantially deteriorated due to slowing growth in product market demand and intense industry competition.

The company acquired 100% equity of Langhe Medical in 2018, resulting in goodwill of RMB 269.367 million. Based on the current operating status of Langhe Medical and an analysis of its future business prospects, the company’s management preliminarily assesses that there are indications of impairment for the goodwill arising from this acquisition.

To more objectively and fairly reflect the company’s financial status and asset value, in accordance with relevant accounting policies such as “Accounting Standards for Business Enterprises No. 8 – Impairment of Assets” and the prudence principle, the company expects to recognize an impairment loss on goodwill of approximately RMB 147 million for 2025. The final impairment amount will be determined after assessment and audit by the appraisal and auditing institutions engaged by the company.

In fact, in the first half of 2025, Well Lead Medical’s performance was still growing. According to the company, despite exceptionally severe geopolitical and economic situations domestically and internationally in H1 2025, the company focused closely on its overall development strategy, market-oriented approaches, intensified new product development, actively expanded markets, and balanced domestic and international sales, achieving stable performance growth. In H1 2025, the company achieved total operating revenue of RMB 745 million, a year-on-year increase of 10.19%; net profit attributable to shareholders of the parent company was RMB 121 million, up 14.17% year-on-year; and net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses was RMB 118 million, an increase of 16.42% year-on-year.

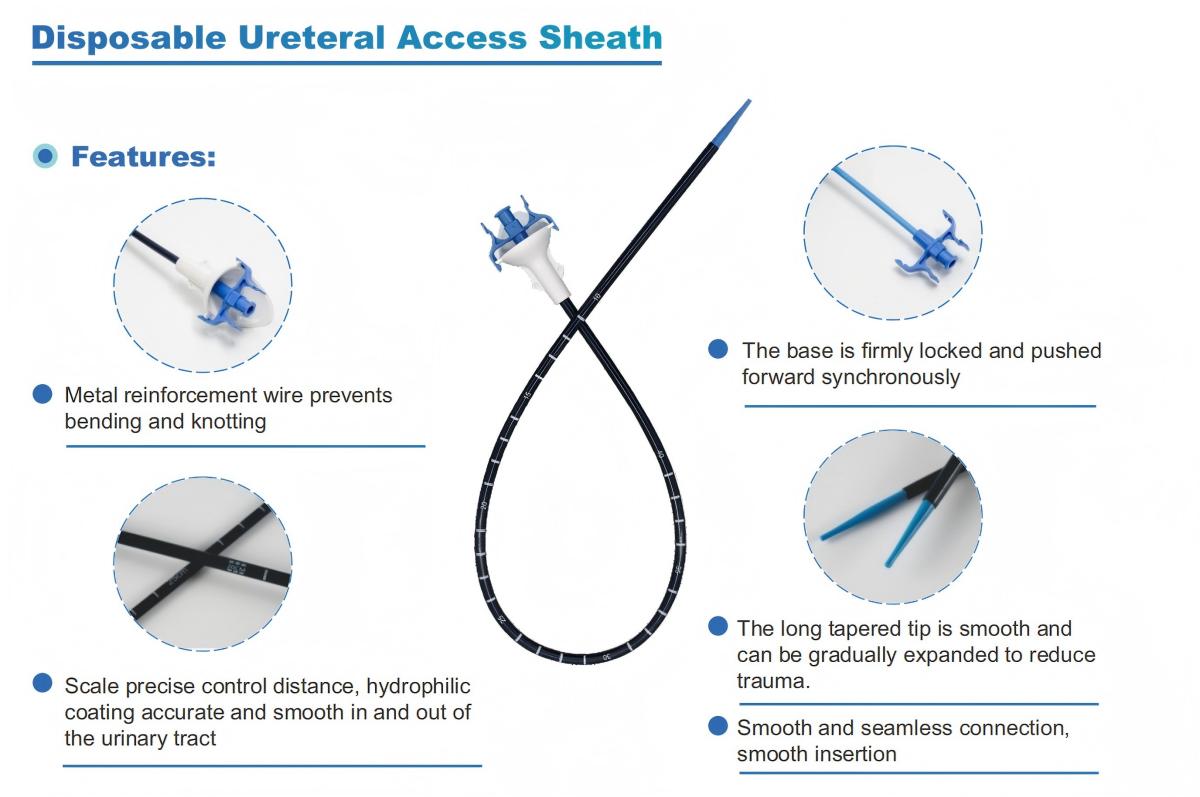

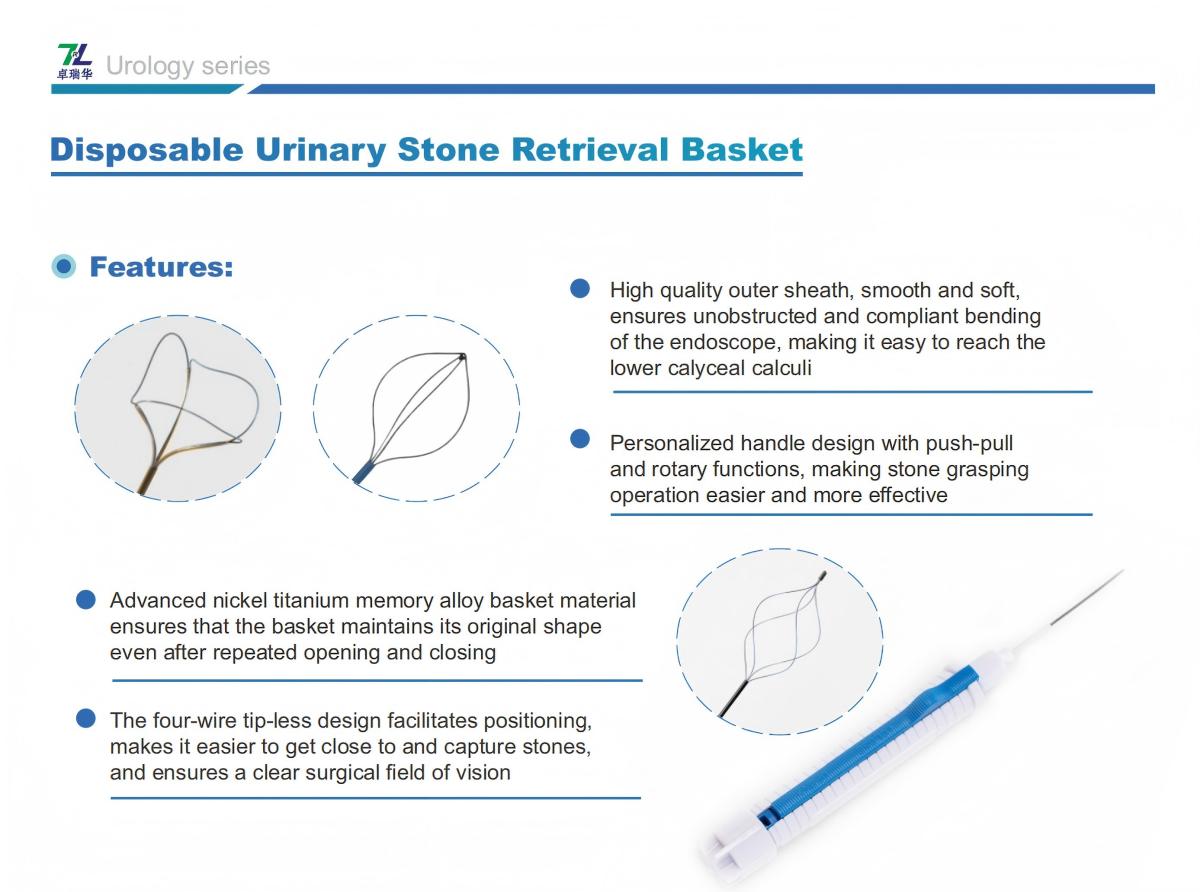

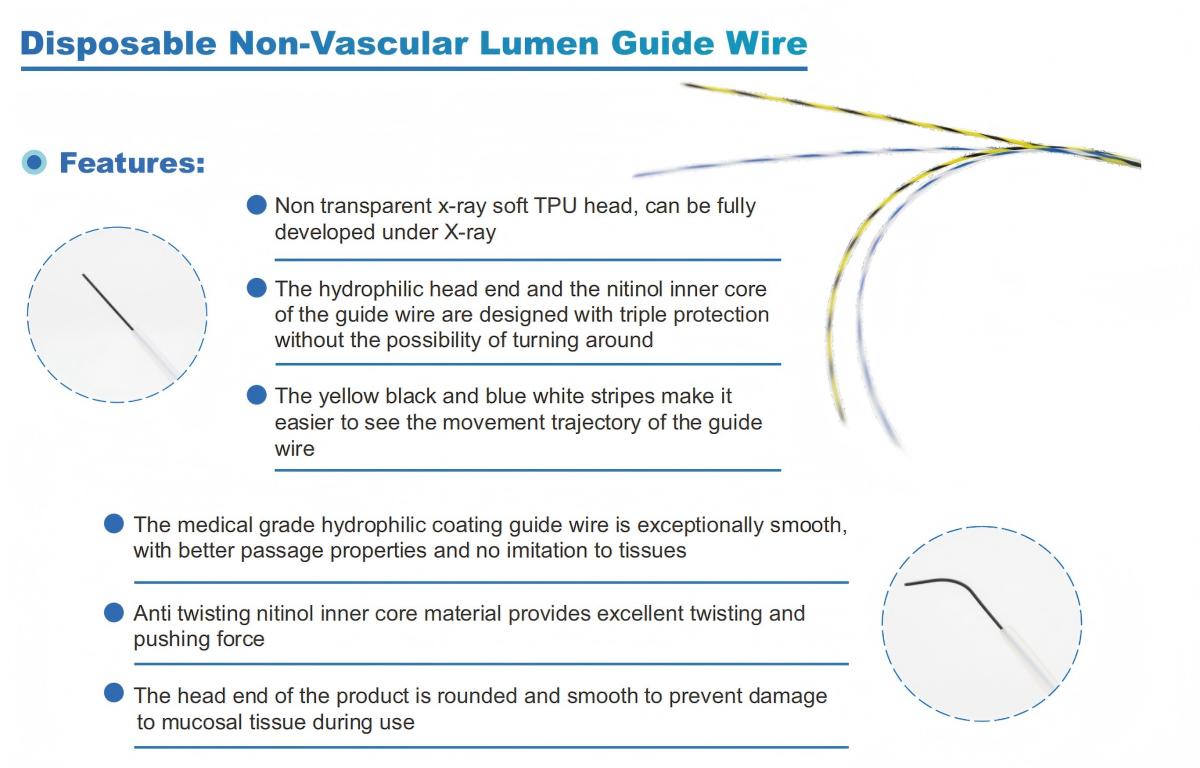

It is worth noting that recently, the National Organization for Centralized Procurement of High-Value Medical Consumables released the selection results of the sixth batch of national volume-based procurement for high-value consumables. In the urological intervention category, Well Lead Medical won bids for five products: Bendable Ureteral Accss Sheath with Suction, Minimally Invasive Expansion Drainage Kit, Ureteral Balloon Dilation Catheter Kit, Endoscopic Stone Retrieval Basket, and Urological Guidewire. However, Well Lead Medical did not disclose the specific winning bid prices.

A relevant staff member from Well Lead Medical’s information disclosure department stated: “Compared to previous end-user prices, the Centralized procurement prices are expected to decrease by 60% to 80%.”

The maximum valid declared price for the Urological Intervention Guidewire was RMB 480; for the Urological Intervention Sheath (without biological pressure measurement function at the target site) was RMB 740; for the Urological Intervention Sheath (with biological pressure measurement function at the target site) was RMB 1,030; for the Ureteral Balloon Dilation Catheter was RMB 1,860; and for the Urological Stone Retrieval Basket was RMB 800.

According to Well Lead Medical’s previous introduction, the comprehensive gross profit margin for its urological surgery product line exceeds 70%. With the market promotion of its star product, the Ureteral Access Sheath, in recent years, the brand effect of Well Lead’s urological products has gradually become apparent in the domestic market. Coupled with import substitution effects, domestic sales revenue for urological products achieved rapid growth in the first half of the year.

Since 2023, the company has intensified efforts to expand overseas sales of its urological products, establishing a professional team for international business development. Through specialized seminars and salons for precise product promotion, significant results have been achieved. Overseas sales revenue for urological products has maintained rapid growth over the past two years.

Simultaneously, with the continuous implementation of customized projects for major overseas clients, the product mix of the overseas business is continuously optimized. The proportion of high-margin products is increasing, driving up the comprehensive gross profit margin of the company’s overseas business. Currently, the company’s R&D pipeline focuses on high-value-added, high-margin products. With the continuous launch of new products, the proportion of high-margin products is expected to keep rising in the future.

Regarding production capacity distribution, Well Lead Medical’s main product capacity is currently concentrated domestically, with production bases in five cities. The Guangzhou headquarters has two sites, mainly producing anesthesia, urological surgery, nursing, and respiratory products. The Haikou site mainly produces urinary catheter products; the Zhangjiagang site mainly produces hemodialysis products; the Suzhou site mainly produces analgesic pump products; and the Ji’an, Jiangxi site mainly produces andrology products within the urological surgery line.

The Phase I capacity of overseas factories primarily supplies U.S. clients. The company estimates that the comprehensive production cost at the Indonesia factory will be slightly higher than domestic costs, and the Mexico factory’s costs will be even higher, though specific data cannot be calculated yet. Shipping and warehousing fees for China factory exported products are borne by clients. If exported from overseas factories, clients’ shipping and warehousing costs would be saved, making them willing to accept a certain degree of price increase for the products.

In the future, the company will negotiate ex-factory prices for products from overseas factories with clients based on the actual production costs at those sites, aiming to maintain the original product gross profit margin levels. It is expected that shifting production overseas will not significantly impact product gross margins.

Well Lead Medical emphasizes that it has continuously been optimizing production capacity and upgrading production automation. Currently, the capacity utilization rates for all products are nearing saturation.

Furthermore, to address increasingly tense overseas geopolitical risks, the company is constructing overseas factories in Indonesia and Mexico. These primarily involve building automated production lines for business with North and South American clients. Upon completion of these two projects, the company’s production capacity and automation levels are expected to be significantly enhanced.

We, Jiangxi Zhuoruihua Medical Instrument Co.,Ltd., is a manufacturer in China specializing in the endoscopic consumables, include GI line such as biopsy forceps, hemoclip, polyp snare, sclerotherapy needle, spray catheter, cytology brushes, guidewire, stone retrieval basket, nasal biliary drainage catheter etc. which are widely used in EMR, ESD, ERCP. And Urology Line, such as ureteral access sheath with suction, ureteral access sheath, disposable Urinary Stone Retrieval Basket, and urology guidewire etc.

Our products are CE certified, and our plants are ISO certified. Our goods have been exported to Europe, North America, Middle East and part of Asia, and widely obtains the customer of the recognition and praise!

Post time: Jan-23-2026