In the field of domestic medical endoscopes, both Flexible and Rigid endoscopes have long been dominated by imported products. However, with the continuous improvement of domestic quality and the rapid advancement of import substitution, Sonoscape and Aohua stand out as representative companies in the field of flexible endoscopes.

The medical endoscope market is still dominated by imports

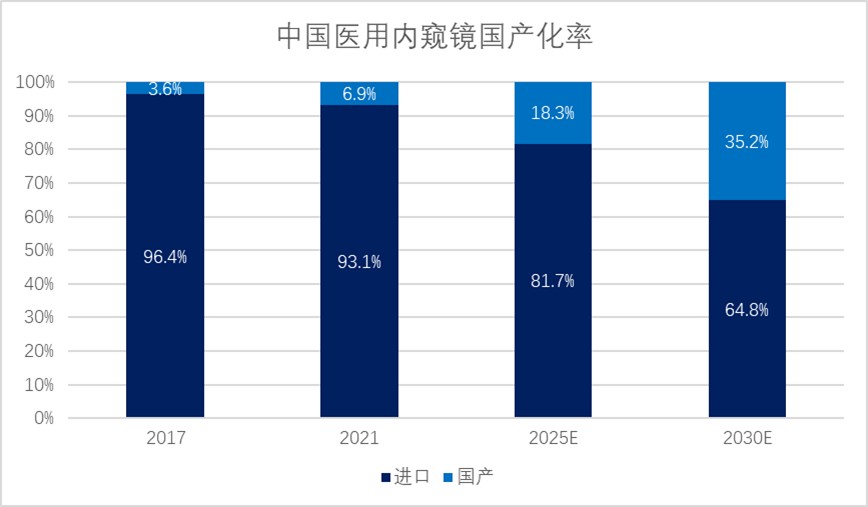

The overall technical level and industrialization process of China’s medical endoscope industry have long lagged behind those of developed countries, but many companies have made great progress in some sub-sectors, gradually catching up with imported mid-to-high-end products in core performance indicators such as image clarity and color reproduction. In 2017, the localization rate of China’s medical endoscope industry was only 3.6%, which has increased to 6.9% in 2021, and it is expected to reach 35.2% in 2030.

Domestication rate of medical endoscopes in China (Import & Domestic)

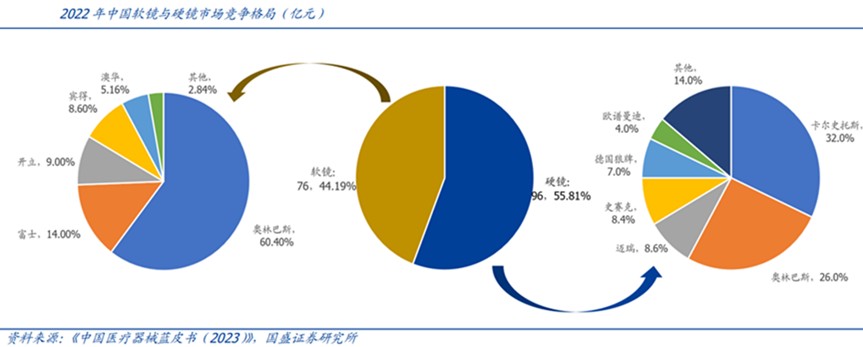

Rigid Endoscope: In 2022, the market size of China’s rigid endoscope market is about 9.6 billion yuan, and imported brands such as Karl Storz, Olympus, Stryker, and Wolf brand account for a total of 73.4% of the market share. Domestic brands started late, but domestic companies represented by Mindray rose rapidly, accounting for about 20% of the market share.

Flexibe Endoscope: In 2022, the market size of China’s flexible endoscope market is about 7.6 billion yuan, and the imported brand Olympus is the only one, accounting for 60.40% of the domestic market share, and Fuji of Japan ranks second with a share of 14%. Domestic companies represented by Sonoscape and Aohua broke the foreign technology monopoly and rose rapidly. In 2022, Sonoscape ranked first in China with a share of 9% and third in the market; Aohua ranked second in China with a share of 5.16% and fifth in the market.

Product Matrix

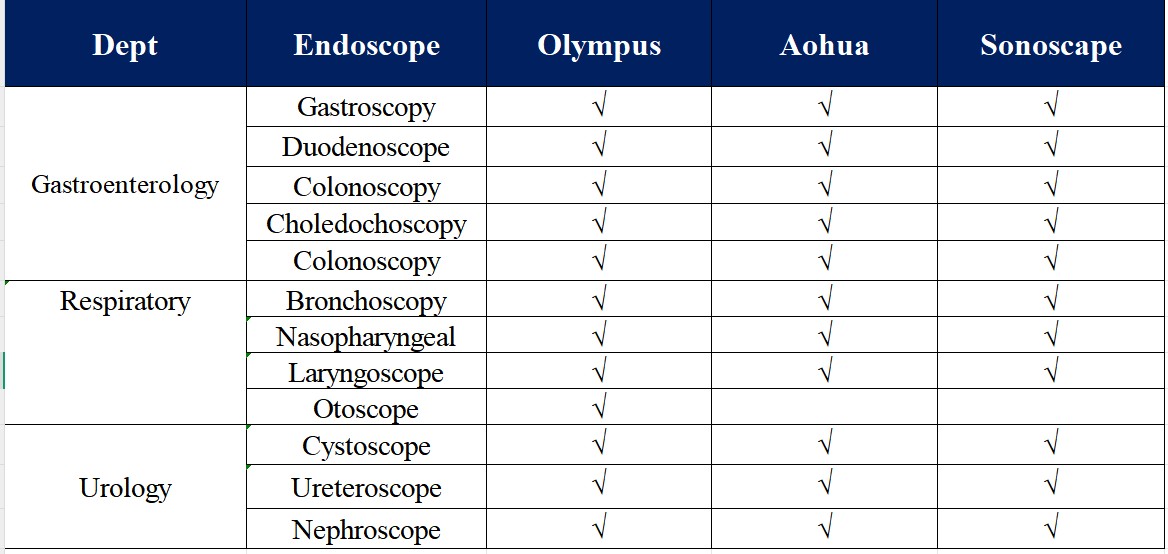

Aohua focuses on medical flexible endoscopes and peripheral consumables. Its products are widely used in clinical departments such as gastroenterology, respiratory medicine, otolaryngology, gynecology, and emergency medicine.

The company has established four major product lines, including ultrasound, endoscopy, minimally invasive surgery, and cardiovascular intervention. The development pattern of multiple product lines has been initially formed. Among them, the endoscopy business has become one of the company’s main business components and is also the company’s main source of growth. The company’s endoscopy business is mainly based on flexible endoscopes, and it also involves endoscopy peripheral consumables and rigid endoscopes.

Flexible Endoscope product layout of each company

Sonoscape and Aohua have both formed a complete product layout in the field of soft endoscopes, and their product systematization is close to that of Olympus, the global leader in flexible endoscopes.

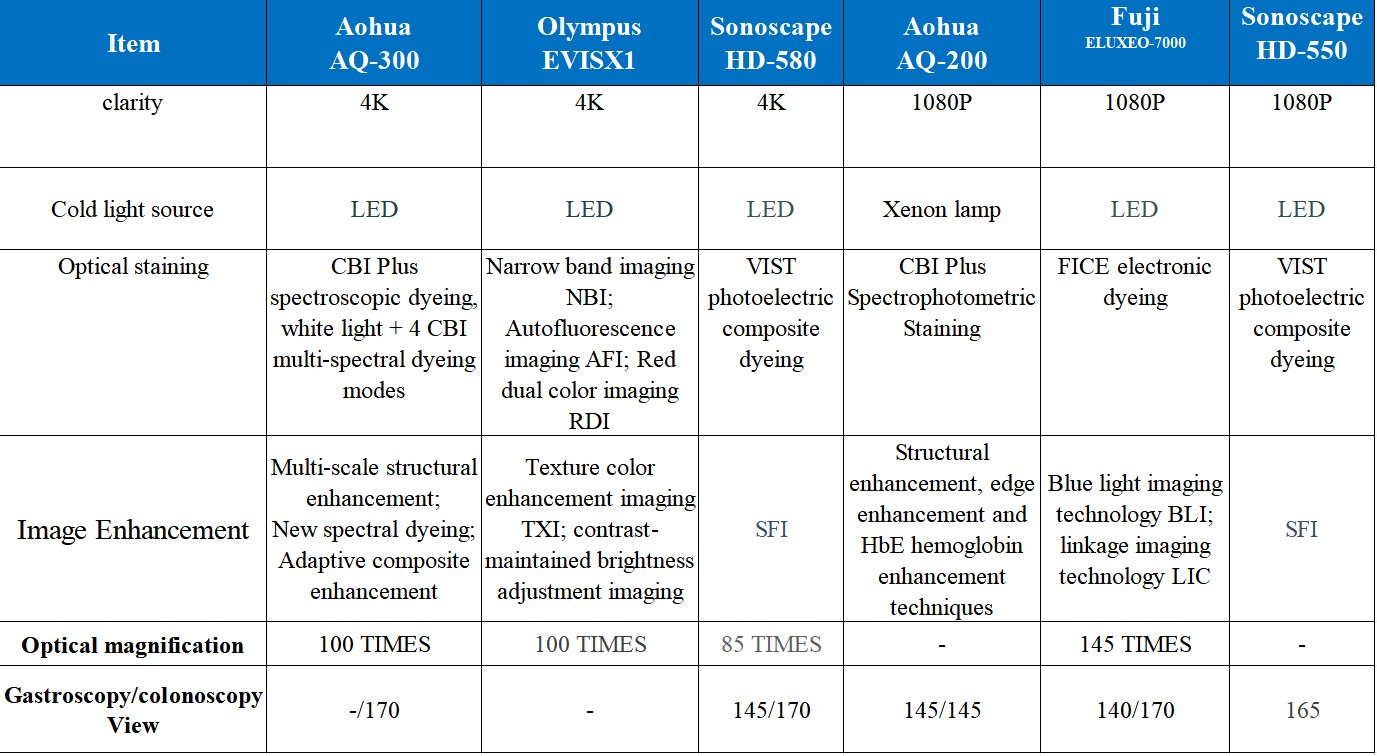

Aohua’s flagship product AQ-300 is positioned in the high-end market, the AQ-200 with balanced performance and price is aimed at the mid-end market, and basic products such as AQ-120 and AQ-100 are suitable for the grassroots market.

Sonoscape’s flexible endoscope product HD-580 is positioned in the high-end market, and the current mainstream product on sale is HD-550, which is positioned in the middle. It has rich product reserves in the low- and mid-end markets.

Performance comparison of mid-range and high-end endoscopes

Sonoscape and Aohua’s high-end endoscope products have already caught up with international leading brands in many aspects of performance. Although the high-end products of the two have been promoted in the market for a short time, they are rapidly advancing in the high-end market by relying on high-quality performance and high cost performance.

At present, the domestic market of Aohua and Sonoscape is mainly in secondary and lower hospitals. At the same time, relying on the launch of high-end products, they have quickly seized the high-end market above the tertiary level in recent years, and their products have been highly recognized by the market. Among them, Sonoscape endoscopes have entered more than 400 tertiary hospitals by 2023; Aohua relied on the promotion of AQ-300 4K ultra-high-definition endoscope system in 2024, and installed (including winning bids) 116 tertiary hospitals that year (73 and 23 tertiary hospitals were installed in 2023 and 2022 respectively).

Operating income

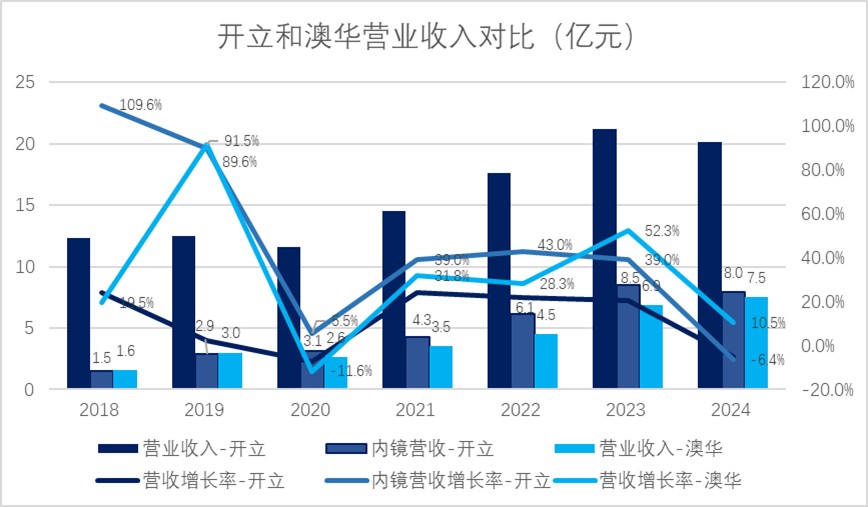

In recent years, the performance of Sonoscape and Aohua has been growing rapidly, especially in endoscopy-related businesses. Although there will be fluctuations in 2024 due to the impact of industry policies, the implementation of subsequent equipment update policies will further drive the recovery of market demand.

Aohua’s endoscopy revenue has increased from 160 million yuan in 2018 to 750 million yuan in 2024. In 2020, due to the impact of the epidemic, the revenue of the year fell by 11.6%. Since the release of high-end products in 2023, the performance growth has further accelerated. In 2024, the growth rate has declined due to the impact of domestic medical device-related policies.

Sonoscape Medical’s comprehensive revenue has increased from 1.23 billion yuan in 2018 to 2.014 billion yuan in 2024. Among them, the revenue of endoscopy-related businesses has increased from 150 million yuan in 2018 to 800 million yuan in 2024. Even under the impact of the epidemic in 2020, it still achieved a certain growth, but under the influence of medical device-related policies in 2024, the endoscopy-related business has declined slightly.

In terms of the company’s comprehensive revenue, Sonoscape’s total business volume is much higher than Aohua’s, but its growth rate is slightly lower than Aohua’s. For the endoscopy business, Sonoscape’s endoscopy-related business is still slightly larger than Aohua’s. In 2024, Sonoscape and Aohua’s endoscopy-related business revenues will be 800 million and 750 million respectively; in terms of growth rate, Sonoscape’s endoscopy business grew faster than Aohua before 2022, but since 2023, due to the increase in the volume of Aohua’s high-end products, Aohua’s growth rate has surpassed Sonoscape’s endoscopy business growth rate.

Comparison of operating income of Aohua and Sonoscape

(100 million yuan)

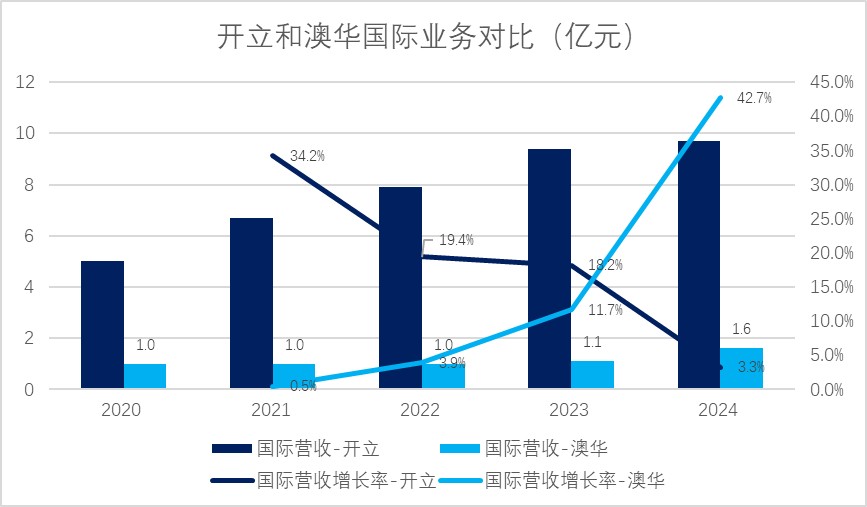

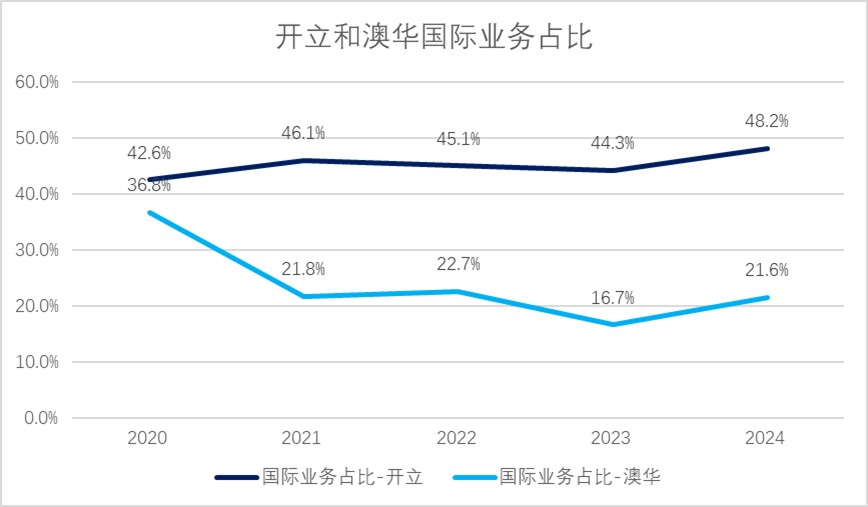

The domestic medical endoscope market is dominated by imported brands. Domestic manufacturers represented by Sonoscape and Aohua are rising rapidly and gradually replacing imports. Domestic business is the most important business area of Sonoscape and Aohua. In 2024, domestic business accounts for 51.83% and 78.43% of Sonoscape and Aohua’s business volume respectively. At the same time, domestic leading companies represented by Sonoscape and Aohua are actively deploying overseas markets, and the business volume of domestic medical endoscopes in the international market continues to rise.

Aohua’s international endoscope business continues to grow, from 100 million yuan in 2020 to 160 million yuan in 2024, but its international business share has dropped from 36.8% in 2020 to 21.6% in 2024.

Sonoscape’s medical business consists of multiple sectors, and the domestic and foreign structures of the endoscope business are not disclosed separately. The company’s overall international business volume is growing, from 500 million yuan in 2020 to 970 million yuan in 2024, and the proportion of international business is relatively stable, between 43% and 48%.

Comparison of international business opened by Aohua and Sonoscape

(100 million yuan)

The proportion of international business opened by Aohua and Sonoscape

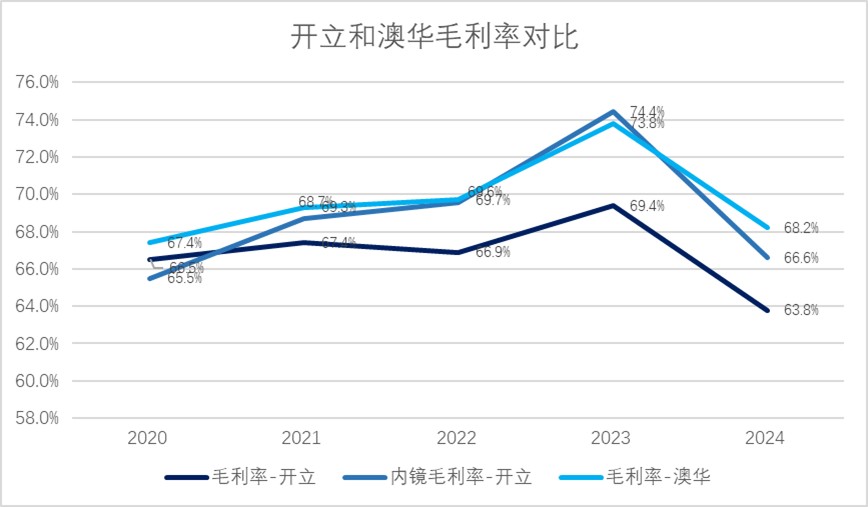

Profit level

As the two leading companies of domestic medical Flexible endoscopes, Aohua and Sonoscape have maintained a relatively high gross profit margin with their high-quality products and commercialization capabilities. Aohua’s gross profit margin has gradually increased from 67.4% in 2020 to 73.8% in 2023, but it will drop to 68.2% in 2024; Sonoscape’s gross profit margin has gradually increased from 66.5% in 2020 to 69.4% in 2023, but it will drop to 63.8% in 2024; Sonoscape’s overall gross profit margin is slightly lower than that of Aohua, but it is mainly due to differences in business structure. Considering only the endoscopy business, Sonoscape’s gross profit margin increased from 65.5% in 2020 to 74.4% in 2023, but it will drop to 66.6% in 2024. The gross profit margins of the two endoscopy businesses are comparable.

Comparison of gross profit between Aohua and Sonoscape

R&D investment

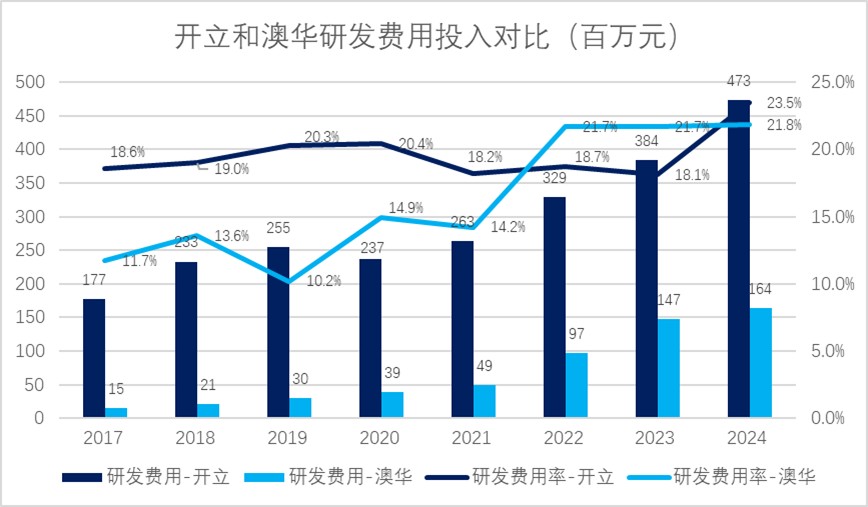

Both Aohua and Sonoscape attach great importance to product research and development. Aohua’s R&D expense rate increased from 11.7% in 2017 to 21.8% in 2024. Sonoscape’s R&D expense rate has remained between 18% and 20% in recent years, but in 2024, R&D investment was further increased, reaching 23.5%.

Comparison of R&D expenditure between Aohua and Sonoscape (million yuan)

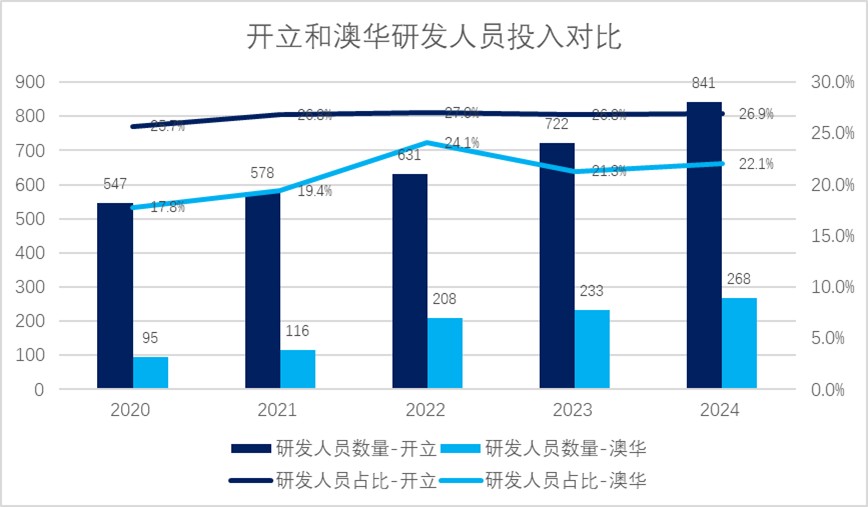

Comparison of R&D personnel investment between Aohua and Sonoscape

Both Aohua and Sonoscape attach great importance to investment in R&D manpower. In recent years, the allocation of Kaili’s R&D personnel has remained stable at 24%-27% of the total number of employees, while the allocation of Aohua’s R&D personnel has remained stable at 18%-24% of the total number of employees.

We, Jiangxi Zhuoruihua Medical Instrument Co.,Ltd., is a manufacturer in China specializing in the endoscopic consumables, such as biopsy forceps, hemoclip, polyp snare, sclerotherapy needle, spray catheter, cytology brushes, guidewire, stone retrieval basket, nasal biliary drainage catheter,ureteral access sheath and ureteral access sheath with suction etc. which are widely used in EMR, ESD, ERCP. Our products are CE certified, and our plants are ISO certified. Our goods have been exported to Europe, North America, Middle East and part of Asia, and widely obtains the customer of the recognition and praise!

Post time: Jul-14-2025