I’m currently waiting for data on the first half of the year’s winning bids for various endoscopes. Without further ado, according to the July 29th announcement from Medical Procurement (Beijing Yibai Zhihui Data Consulting Co., Ltd., hereinafter referred to as Medical Procurement), rankings are broken down by region and brand, with further breakdowns by complete sets, single endoscopes, and specialty.

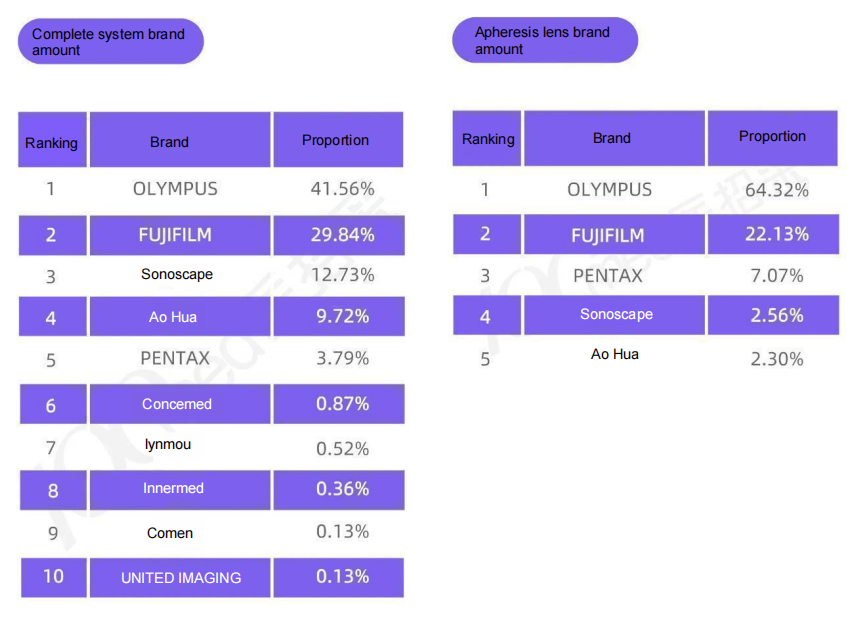

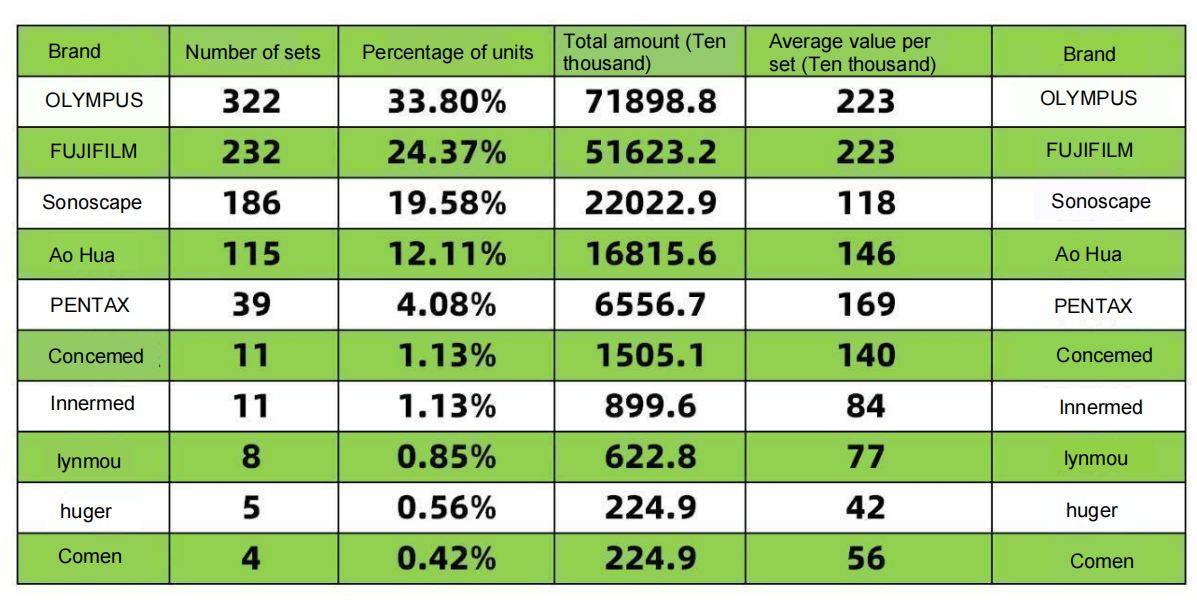

First, here are the figures for the sales of complete sets and single-lens mirrors in the first half of 2025 (next image/data source: Medical Procurement)

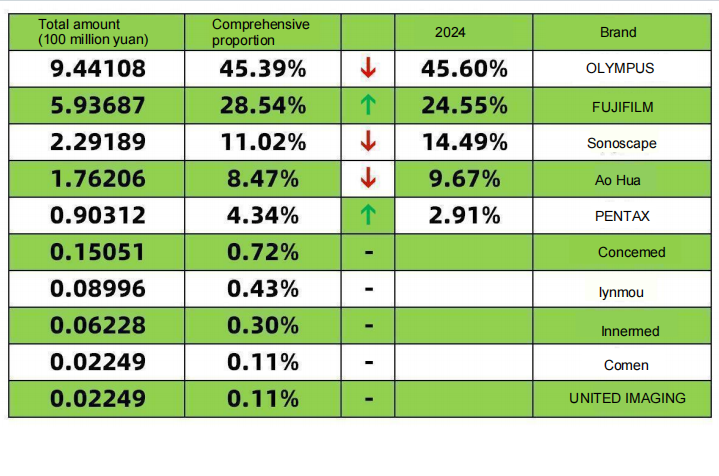

The total amount of complete sets is 1.73 billion (83.17%), and that of single mirrors is 350 million (16.83%). If we convert it into the comprehensive amount (complete sets + mirrors), and combine it with the 2024 gastrointestinal endoscope market share ranking (data source: Bidi Bidding Network), the proportion and changes in the first half of the year are as follows:

In terms of value, compared to 2024, the following figures are true:

The three major imported brands account for 78.27% of sales, a 5.21% increase from 73.06% in 2024. Fujifilm’s share of sales increased by 4%, Apollo’s sales decreased slightly, and Pentax’s sales rose by 1.43%. This suggests that after the localization of the imported brand (Fujifilm) for specialized gastroenteroscopes, the competitiveness of domestic brands will decline in 2025, even facing significant internal competition.

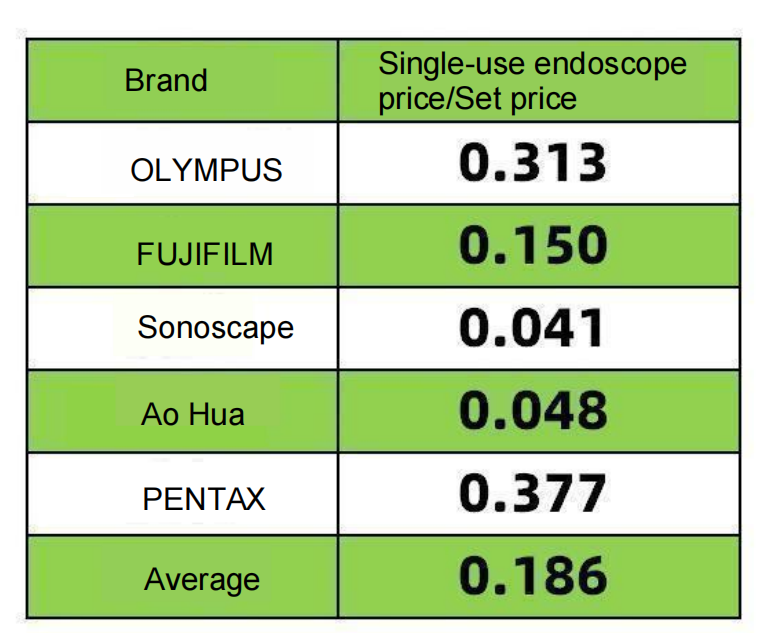

Set a value: Single-use endoscope price/Set price (calculated based on medical procurement data)

Fujifilm’s rise is driven by improved gastrointestinal endoscope quality (continued promotion of LCI and BLI) and the localization of VP7000 complete sets. Both the ID card and the shipping price are attractive to mid- to high-end customers. Fujifilm is aggressively counterattacking Olympus and closely following Olympus, focusing on early-stage cancer. Olympus’s complete set budget cannot pass import certification, so Fujifilm is highly likely to win the deal. This is reflected in Fujifilm’s single lens/complete set ratio of (0.15). While Fujifilm has a higher number of complete sets, its lens/set ratio is significantly lower than Olympus and Fujifilm. This shows that Fujifilm is currently focusing on domestic ID cards and complete sets, which is indeed advantageous.

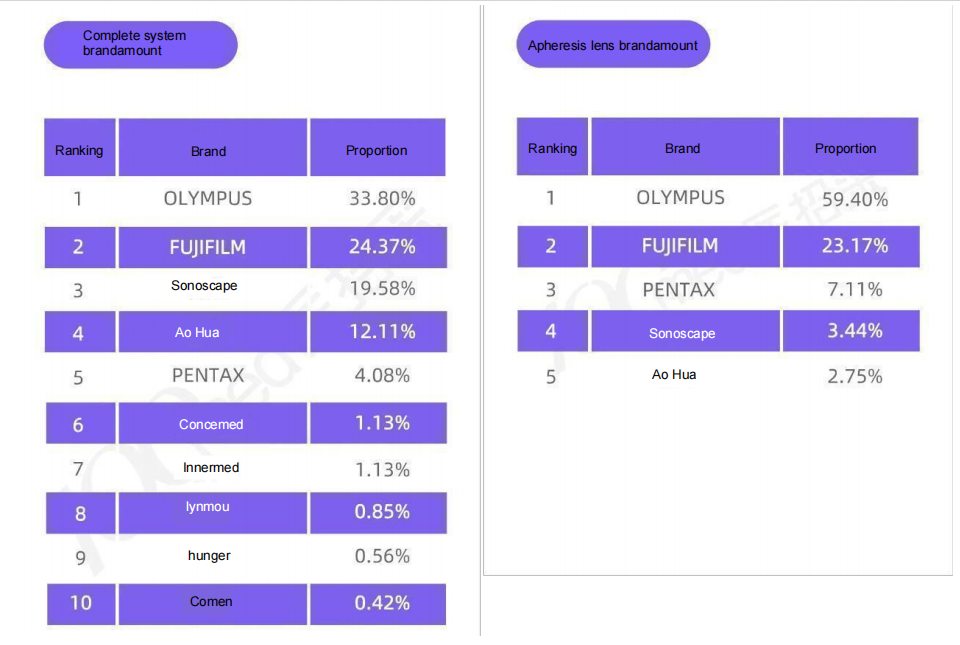

Olympus’s stability: Olympus, the No. 1 player, is committed to its position. After three years of resilience, despite declining market share, it has identified key areas of excellence and is moving towards the high-end market. It has updated its scopes based on its large inventory of mainframes, adapting to policies and adapting to domestic production strategies. Perhaps, Olympus is also frustrated by the difficulties it faces in developing complete sets of equipment due to the lack of import permits. The global formation of the GIS (Gastrointestinal Solutions Division) in FY26, with a strong focus on gastroenterology, may help accelerate the introduction of new scopes into China. The main sales mainframes remain the CV-290, followed by the CV-1500. After Olympus’s localization, its market share is expected to increase by >5%. Data on the number of complete sets and single scopes in the first half of 2025 (Image below/data source: Medical Procurement)

According to medical procurement data: 952 sets of gastrointestinal endoscopes and 1,214 single endoscopes were sold nationwide within 1 hour. Rough conversion:

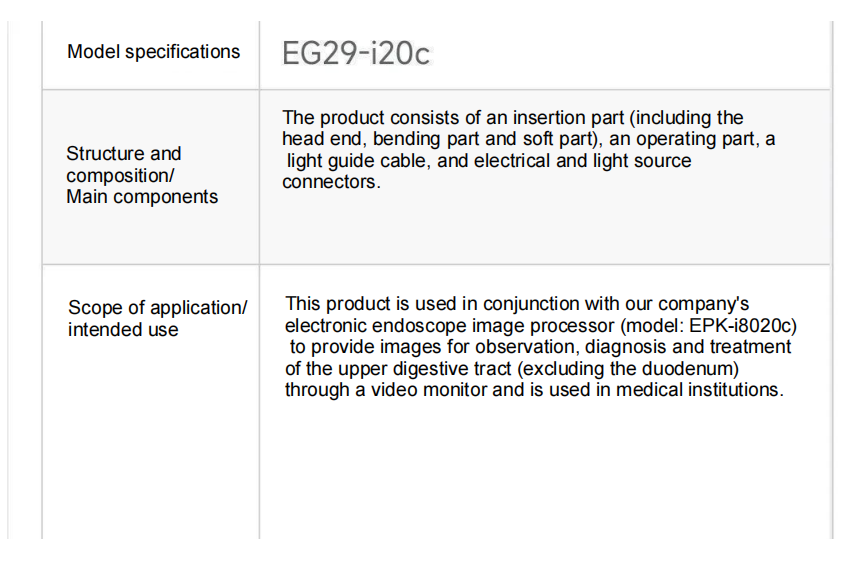

Pentax’s 1H share was 4.34%, a slight increase from 2.91% in 2024. Pentax has its loyal fans, and considering the 2025 1H single-lens/set ratio (0.377), Pentax actually surpassed Olympus (0.31). Its mainframe market share is much larger than that of domestic manufacturers. In this last-ditch effort, Pentax is frantically adding scopes to its mainframes (see the Q1 gastroenteroscope data released by Bidi Bidding Network: 10 series gastroenteroscopes). A slight increase in market share is understandable. Furthermore, compared to Olympus and Fujifilm, the lower price of sets makes it quite attractive. The good news for Pentax is that the import license for the new i20 gastroscope, which connects to the 8020c mainframe, has been issued. The bad news is that the 8020 mainframe has not yet been approved.

Sonoscape and Aohua, especially in terms of dollar volume, will see a decline in their share of Sonoscape by 2024. This may be due to the fact that most national medical funding projects are implemented in the second half of the year, leading to a surge in market share in the fourth quarter.

One thing that shouldn’t be overlooked is that Sonoscape’s average price per set is 280,000 yuan lower than Aohua’s. We hope Sonoscape maintains its core focus on endoscopy and is less susceptible to internal and external influences. Sonoscape’s scope/set ratio (0.041) and Aohua’s (0.048) are related to a small base of endoscopy equipment, low repurchase rates among low-end customers, and a focus on single-item projects. After completing a set, ongoing maintenance will yield further results. Sonoscape and Aohua need to strengthen their repeat purchase strategy, tackling both challenges head-on. Of course, my analysis may be biased, as Aohua’s price per set is 280,000 yuan higher than Sonoscape’s, which allows them to cover the cost of an extra scope. Perhaps Aohua included an extra scope in their recommended configurations.

Ranked 678910, the sale of two or three units for 2 million yuan is a fluke.

Concemed, the leading domestic brand in the second tier, boasts a high average price per unit, with 15 million RMB awarded in the past six months. Winning hospitals include township and tertiary hospitals, with prices ranging from 700,000 to 2.5 million RMB. The main unit models are 1000s and 1000p, while the scopes are 1000 and 800 RMB. Besides Aohua Kaili, Concemed is the first brand to offer comprehensive upper and lower scopes, offering the most value. The earlier you enter, the sooner you’ll benefit. Concemed is the most widely heard domestic brand after Aohua Kaili. We’ll see how Concemed’s magnifying endoscopes perform later.

Comen, the product layout is similar to Mindray, but the style is different. I have tried it and it feels good like Concemed. Let’s see how it performs at the end of the year.

InnerMed started with endoscopic ultrasound and ended up doing endoscopy a little later. The subsequent small probe + endoscope solution is suitable for more mid-range groups and has potential.

Huger, whose products involve multiple departments, can be regarded as the big brother of endoscopy. It originally focused on the respiratory department, and now in the field of digestive system, it hopes to make great progress.

Lynmou, I don’t know enough about this. Are R&D and production separate? How do we communicate? Since it’s domestically produced, have you considered designing a smaller operating handle? Is it more suitable for Asians and women?

Finally, selling complete sets is like conquering a city; occupying one unit is like conquering another; selling individual lenses is like cultivating a field; continuous cultivation leads to continuous harvests. Both are important. The key to operating specialized lens types is providing long-term service.

We, Jiangxi Zhuoruihua Medical Instrument Co.,Ltd., is a manufacturer in China specializing in the endoscopic consumables, such as biopsy forceps, hemoclip, polyp snare, sclerotherapy needle, spray catheter, cytology brushes, guidewire, stone retrieval basket, nasal biliary drainage cathete etc. which are widely used in EMR, ESD, ERCP.

Our products are CE certified, with FDA 510k Approval and our plants are ISO certified. Our goods have been exported to Europe, North America, Middle East and part of Asia, and widely obtains the customer of the recognition and praise!

Post time: Sep-19-2025