1. Basic concepts and technical principles of multiplex endoscopes

A multiplexed endoscope is a reusable medical device that enters the human body through the natural cavity of the human body or a small incision in minimally invasive surgery to help doctors diagnose diseases or assist in surgery. The medical endoscope system consists of three core parts: the endoscope body, the image processing module and the light source module. The endoscope body also contains key components such as imaging lenses, image sensors (CCD or CMOS), acquisition and processing circuits. From the perspective of technological generations, multiplexed endoscopes have evolved from rigid endoscopes to fiber endoscopes to electronic endoscopes. Fiber endoscopes are made using the principle of optical fiber conduction. They are composed of tens of thousands of orderly arranged glass fiber filaments to form a reflective beam, and the image is transmitted without distortion through repeated refraction. Modern electronic endoscopes use micro-image sensors and digital signal processing technology to significantly improve imaging quality and diagnostic accuracy.

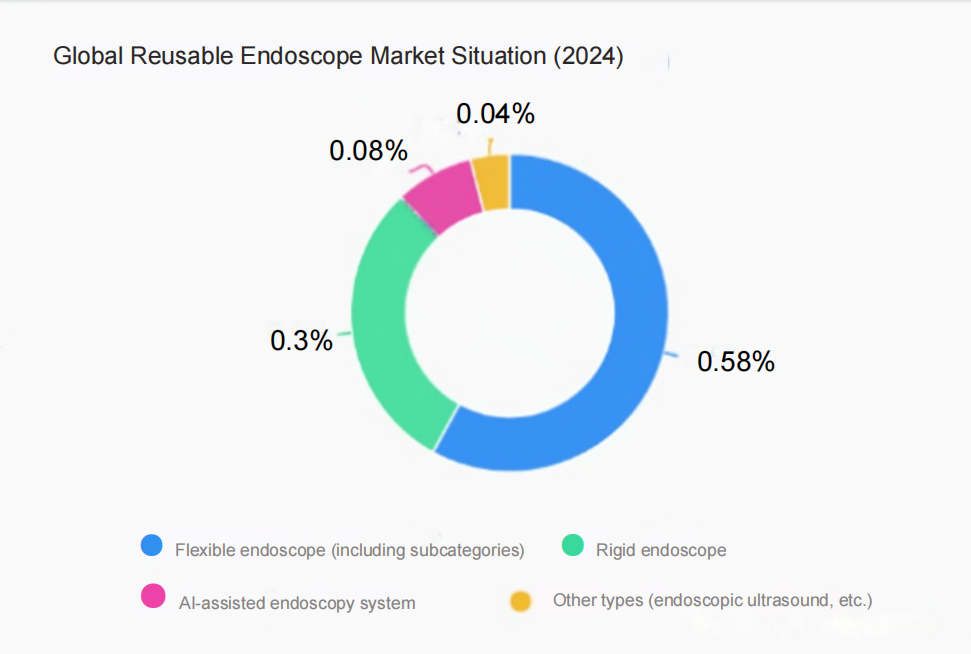

2. Market situation of reusable endoscopes

|

Category Dimension |

Type |

Market Share |

Remark |

|

Product Structure |

Rigid Endoscopy |

1. Global market size is US$7.2 billion.2. Fluorescence hard endoscope is the fastest growing segment, gradually replacing traditional white light endoscope. | 1. Application areas: general surgery, urology, thoracic surgery and gynecology.2. Major manufacturers: Karl Storz, Mindray, Olympus, etc. |

|

Flexible Endoscopy |

1. Global market size is 33.08 billion yuan. 2. Olympus accounts for 60% (flexible endoscope field). |

1.Gastrointestinal endoscopes account for more than 70% of the flexible endoscope market 2. Major manufacturers: Olympus, Fuji, sonoscape, Aohua, etc. |

|

|

Imaging Principle |

Optical endoscope |

1. The global market size of cold light source endoscopes is 8.67 billion yuan. 2.0 Lympus’ market share exceeds 25%. |

1. Based on the principle of geometric optical imaging 2. Contains objective lens system, optical transmission/relay system, etc. |

|

|

Electronic endoscope |

Global sales of high-definition electronic bronchoscopes reached US$810 million. |

1. Based on photoelectric information conversion and image processing methods 2. Including objective lens system, image array photoelectric sensor, etc. |

|

Clinical Application |

Digestive endoscopy |

Occupies 80% of the soft lens market, of which Olympus accounts for 46.16%. |

Domestic brand sonoscape Medical surpasses Fuji in market share of secondary hospitals. |

|

Respiratory endoscopy |

Olympus accounts for 49.56% of the total market share of digestive endoscopes. |

Domestic substitution is accelerating, and Aohua Endoscopy has grown significantly. |

|

|

Laparoscopy/Arthroscopy |

Thoracoscopy and laparoscopy account for 28.31% of China’s endoscopy market. |

1. 4K3D technology share increased by 7.43%. 2. Mindray Medical ranked first in secondary hospitals. |

1) Global market: Olympus monopolizes the market for soft lenses (60%), while the market for hard lenses grows steadily (US$7.2 billion). Fluorescent technology and 4K3D become the direction of innovation.

2) China Market: Regional differences: Guangdong has the highest purchase amount, coastal provinces are dominated by imported brands, and domestic substitution is accelerating in the central and western regions. Domestic breakthrough: The localization rate of hard lenses is 51%, and soft lens openings/Australia and China account for 21% in total. Policies promote high-end substitution. Hospital stratification: Tertiary hospitals prefer imported equipment (65% share), and secondary hospitals have become a breakthrough for domestic brands.

3.Advantages and challenges of reusable endoscopes

|

Advantages |

Specific manifestations |

Data support |

|

Outstanding economic performance |

A single device can be reused 50-100 times, with long-term costs far lower than disposable endoscopes (single-use costs are only 1/10). |

Take gastroenteroscopy as an example: the purchase price of a reusable endoscope is RMB 150,000-300,000 (usable for 3-5 years), and the cost of a disposable endoscope is RMB 2,000-5,000. |

|

High technical maturity |

Technologies such as 4K imaging and AI-assisted diagnosis are preferred for multiplexing, with image clarity 30%-50% higher than that of one-time use. |

In 2024, the penetration rate of 4K in global high-end multiplex endoscopes will reach 45%, and the rate of AI-assisted functions will exceed 25%. |

|

Strong clinical adaptability |

The mirror body is made of durable material (metal + medical polymer) and can be adapted to different patient sizes (such as ultra-thin mirrors for children and standard mirrors for adults). |

The suitability rate of rigid endoscopes in orthopedic surgery is 90%, and the success rate of flexible endoscopes in gastroenterology is over 95%. |

|

Policy and supply chain stability |

Reusable products are the mainstream in the world, and the supply chain is mature (Olympus, sonoscape and other companies have a stocking cycle of less than 1 month). |

Reusable equipment accounts for more than 90% of procurement in China’s tertiary hospitals, and policies do not restrict the use of reusable equipment. |

|

Challenge |

Specific Issues |

Data support |

|

Cleaning and disinfection risks |

Reuse requires strict disinfection (must comply with AAMI ST91 standards), and improper operation may lead to cross infection (incidence rate 0.03%). |

In 2024, the US FDA recalled 3 reusable endoscopes due to bacterial contamination caused by cleaning residues. |

|

High maintenance cost |

Professional maintenance (cleaning equipment + labor) is required after each use, and the average annual maintenance cost accounts for 15%-20% of the purchase price. |

The average annual maintenance cost of a flexible endoscope is 20,000-50,000 yuan, which is 100% higher than that of a disposable endoscope (no maintenance). |

|

Pressure of technological iteration |

Disposable endoscope technology catches up (e.g. 4K module cost drops by 40%), extrusion reuse low-end market. |

In 2024, the growth rate of China’s disposable endoscope market will reach 60%, and some grassroots hospitals will begin to purchase disposable endoscopes to replace low-end reusable endoscopes. |

|

Tighter regulations |

EU MDR and US FDA raise reprocessing standards for reusable endoscopes, increasing compliance costs for companies (testing costs increased by 20%). |

In 2024, the return rate of reusable endoscopes exported from China due to compliance issues will reach 3.5% (only 1.2% in 2023). |

4.Market Status and Major Manufacturers

The current global endoscope market presents the following characteristics:

Market structure:

Foreign brands dominate: International giants such as KARL STORZ and Olympus still occupy the main market share. Taking hysteroscopes as an example, the top three sales rankings in 2024 are all foreign brands, accounting for a total of 53.05%.

The rise of domestic brands: According to Zhongcheng Digital Technology data, the market share of domestic endoscopes has increased from less than 10% in 2019 to 26% in 2022, with an average annual growth rate of more than 60%. Representative companies include Mindray, sonoscape, Aohua, etc.

Technical competition focus:

Imaging technology: 4K resolution, CMOS sensor replacing CCD, EDOF depth of field extension technology, etc.

Modular design: The replaceable probe design extends the service life of core components.

Intelligent cleaning: A new cleaning system that combines AI visual recognition with dynamic proportioning of multi-enzyme cleaning agents.

|

Ranking

|

Brand |

China Market Share |

Core Business Areas |

Technological advantages and market performance |

| 1 | Olympus | 46.16% | Flexible endoscopes (70% in gastroenterology), endoscopy, and AI-assisted diagnosis systems. | 4K imaging technology has a global market share of over 60%, China’s tertiary hospitals account for 46.16% of procurement, and the Suzhou factory has achieved localized production. |

| 2 | Fujifilm | 19.03% | Flexible endoscope (blue laser imaging technology), respiratory ultra-thin endoscope (4-5mm). | The second largest soft lens market in the world, China’s secondary hospital market share was surpassed by sonoscape Medical, and revenue in 2024 will drop by 3.2% year-on-year. |

| 3 | Karl Storz | 12.5% | Rigid endoscope (laparoscopy accounts for 45%), 3D fluorescence technology, exoscope. | The rigid endoscope market ranks first in the world. The domestically produced products of the Shanghai manufacturing base have been approved. The new purchases of 3D fluorescent laparoscopes account for 45%. |

| 4 | Sonoscape medical | 14.94% | Flexible endoscope (ultrasound endoscope), AI polyp detection system, rigid endoscope system. | The company ranks fourth in China’s soft lens market, with tertiary hospitals accounting for 30% of 4K+AI product purchases, and revenue increasing by 23.7% year-on-year in 2024. |

| 5 | HOYA(Pentax Medical) | 5.17% | Flexible endoscope (gastroenteroscopy), rigid endoscope (otolaryngology). | After being acquired by HOYA, the integration effect was limited, and its market share in China fell out of the top ten. Its revenue in 2024 fell by 11% year-on-year. |

| 6 | Aohua Endoscopy | 4.12% | Flexible endoscopy (gastroenterology), high-end endoscopy. | The overall market share in the first half of 2024 is 4.12% (soft endoscope + hard endoscope), and the profit margin of high-end endoscopes will increase by 361%. |

| 7 | Mindray Medical | 7.0% | Rigid endoscope (hysteroscope accounts for 12.57%), grassroots hospital solutions. | China ranks third in the hard endoscope market, with county hospitals’ procurement growth exceeding 30%, and overseas revenue share increasing to 38% in 2024. |

| 8 | Optomedic | 4.0% | Fluoroscope (Urology, Gynecology), domestic alternative benchmark. | China’s market share of fluorescent hard lenses exceeds 40%, exports to Southeast Asia increased by 35%, and R&D investment accounted for 22% |

| 9 | Stryker | 3.0% | Neurosurgery rigid endoscope, urology fluorescent navigation system, arthroscope. | The market share of neuroendoscopes exceeds 30%, and the purchase growth rate of county hospitals in China is 18%. The grassroots market is squeezed by Mindray Medical. |

| 10 | Other Brands | 2.37% | Regional brands (such as Rudolf, Toshiba Medical), specific segments (such as ENT mirrors). |

5.Core technology progress

1) Narrow-band imaging (NBI): Narrow-band imaging is an advanced optical digital method that significantly enhances the visualization of mucosal surface structures and microvascular patterns through the application of specific blue-green wavelengths. Clinical studies have shown that NBI has increased the overall diagnostic accuracy of gastrointestinal lesions by 11 percentage points (94% vs 83%). In the diagnosis of intestinal metaplasia, the sensitivity has increased from 53% to 87% (P<0.001). It has become an important tool for early gastric cancer screening, which can assist in distinguishing benign and malignant lesions, targeted biopsy, and delineating resection margins.

2) EDOF extended depth of field technology: The EDOF technology developed by Olympus achieves extended depth of field through light beam splitting: two prisms are used to split the light into two beams, focusing on near and far images respectively, and finally merging them into a clear and delicate image with a wide depth of field on the sensor. In the observation of gastrointestinal mucosa, the entire lesion area can be clearly presented, significantly improving the lesion detection rate.

3) Multimodal imaging system

The EVIS X1™ system integrates multiple advanced imaging modes: TXI technology: improves adenoma detection rate (ADR) by 13.6%; RDI technology: enhances the visibility of deep blood vessels and bleeding points; NBI technology: optimizes the observation of mucosal and vascular patterns; transforms endoscopy from an “observation tool” to an “auxiliary diagnosis platform”.

6.Policy environment and industry orientation

Key policies that will affect the endoscopy industry in 2024-2025 include:

Equipment update policy: The March 2024 “Action Plan for Promoting Large-Scale Equipment Updates and Consumer Goods Replacement” encourages medical institutions to accelerate the update and transformation of medical imaging equipment.

Domestic substitution: The 2021 policy requires 100% procurement of domestic products for 3D laparoscopes, choledochoscopes, and intervertebral foramina.

Approval optimization: Medical endoscopes are adjusted from Class III to Class II medical devices, and the registration period is shortened from more than 3 years to 1-2 years.

These policies have significantly promoted the R&D innovation and market access of domestic endoscopes, creating a favorable development environment for the industry.

7. Future development trends and expert opinions

1) Technology integration and innovation

Dual-scope joint technology: Laparoscope (hard scope) and endoscope (soft scope) collaborate in surgery to solve complex clinical problems.

Artificial intelligence assistance: AI algorithms assist in lesion identification and diagnostic decision-making.

Material science breakthrough: Development of new scope materials that are more durable and easier to clean.

2) Market differentiation and development

Experts believe that disposable endoscopes and reusable endoscopes will coexist for a long time:

Disposable products: suitable for infection-sensitive scenarios (such as emergency, pediatrics) and primary medical institutions.

Reusable products: maintain cost and technical advantages in high-frequency use scenarios in large hospitals.

Mole Medical Analysis pointed out that for institutions with an average daily usage of more than 50 units, the comprehensive cost of reusable instruments is lower.

3) Domestic substitution is accelerating

The domestic share has increased from 10% in 2020 to 26% in 2022, and is expected to continue to increase. In the fields of fluorescence endoscopes and confocal microendoscopy, my country’s technology is already internationally advanced. Driven by policies, it is “only a matter of time” to complete domestic substitution.

4) Balance between environmental and economic benefits

Reusable endoscopes can theoretically reduce resource consumption by 83%, but the problem of chemical wastewater treatment in the disinfection process needs to be solved. The research and development of biodegradable materials is an important direction in the future.

Table: Comparison between reusable and disposable endoscopes

|

Comparison Dimensions |

Reusable Endoscope |

Disposable Endoscope |

|

Cost per use |

Low(After apportionment) |

High |

|

Initial investment |

High |

Low |

|

Image quality |

excellent

|

good |

|

Risk of infection |

Medium (depending on disinfection quality) |

Very low |

|

Environmental friendliness |

Medium (generating disinfection wastewater) |

Poor (Plastic waste) |

|

Applicable scenarios |

High frequency use in large hospitals |

Primary hospitals/infection-sensitive departments |

Conclusion: In the future, endoscopic technology will show a development trend of “precision, minimally invasive, and intelligent”, and reusable endoscopes will still be the core carrier in this evolution process.

We, Jiangxi Zhuoruihua Medical Instrument Co.,Ltd., is a manufacturer in China specializing in the endoscopic consumables, such as biopsy forceps, hemoclip, polyp snare, sclerotherapy needle, spray catheter, cytology brushes, guidewire, stone retrieval basket, nasal biliary drainage catheter,ureteral access sheath and ureteral access sheath with suction etc. which are widely used in EMR, ESD, ERCP. Our products are CE certified, and our plants are ISO certified. Our goods have been exported to Europe, North America, Middle East and part of Asia, and widely obtains the customer of the recognition and praise!

Post time: Jul-25-2025