Deep Insights The “Game of Thrones” on the 4.57 Billion Table

2025 has witnessed another surge of waves in the Chinese GI Endoscopy Market. The latest data from YiZhaoCai reveals a total sample market value of ¥4.57 billion (RMB), comprising 1,735 sets of complete systems and 2,839 individually procured endoscope bodies. In this high-stakes game surrounded by industry giants and rising contenders, who are the true winners? How will the tide of domestic substitution reshape the future market landscape?

This report, based on exclusive data from YiZhaoCai, provides a deep analysis of this “Game of Thrones” valued at ¥4.57 billion from four key dimensions: Region, Brand, Centralized Procurement, and New Entrants.

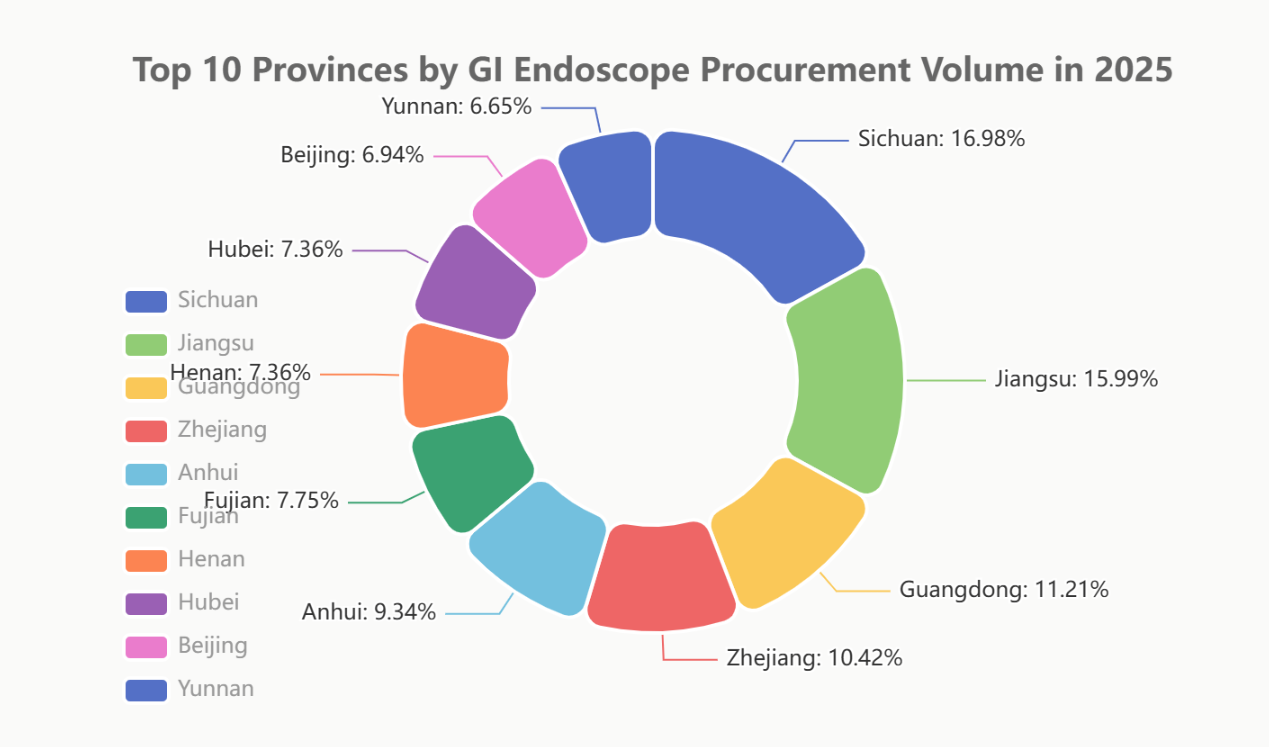

I. Regional Competition: Sichuan, Jiangsu, and Guangdong Lead the Race; Top 10 Provinces Account for Over 57% Market Share

The procurement demand for GI endoscopes is highly correlated with regional economic strength and healthcare development levels. In 2025, the market exhibited a pronounced “head concentration” effect.

Sichuan (9.86%) surprisingly claimed the top spot, becoming the largest GI endoscopy market nationwide. This can be attributed to its powerful “siphoning effect” on neighboring provinces as a “Western Medical Hub.” Following closely, Jiangsu (9.28%) and Guangdong (6.51%) secured the top three positions, leveraging their robust economic strength and large population bases. Notably, the top ten provinces collectively accounted for 57.08% of the total market share, indicating a growing Matthew effect.

II. Brand Showdown: Foreign vs. Domestic, Undercurrents in the “Four-Power Rivalry”

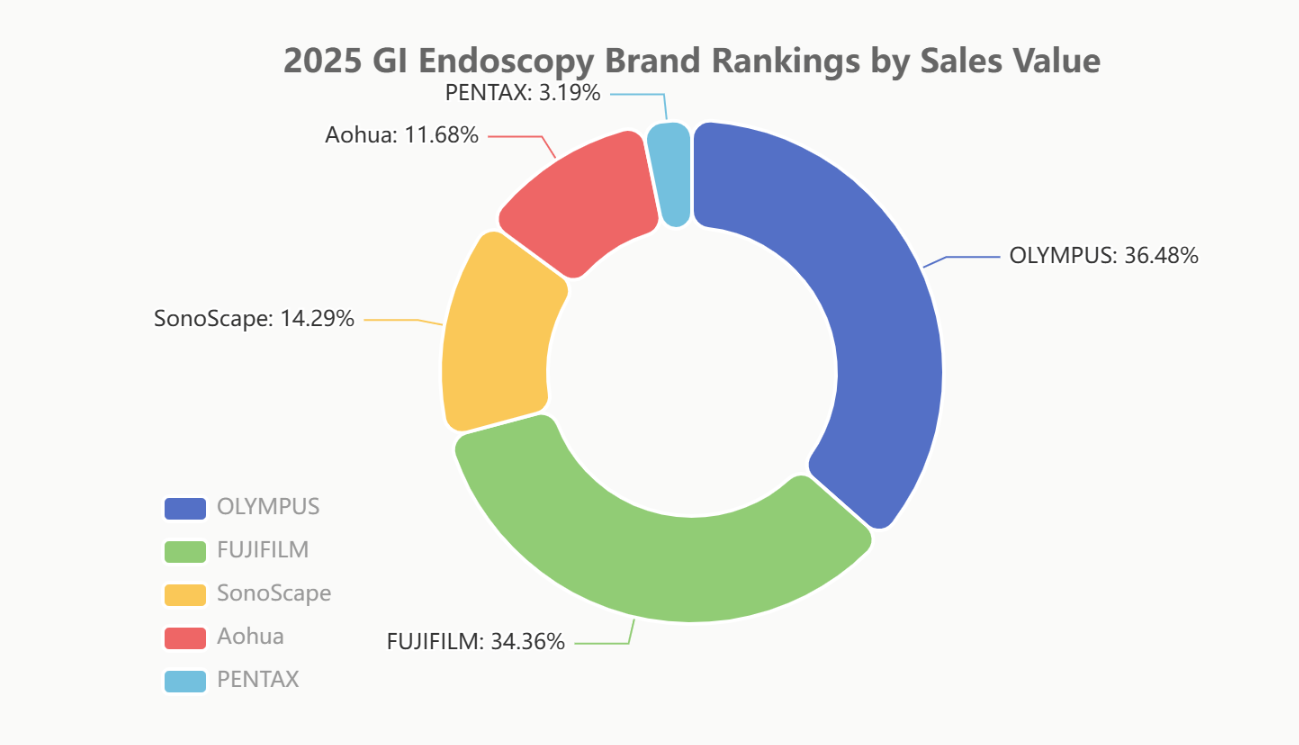

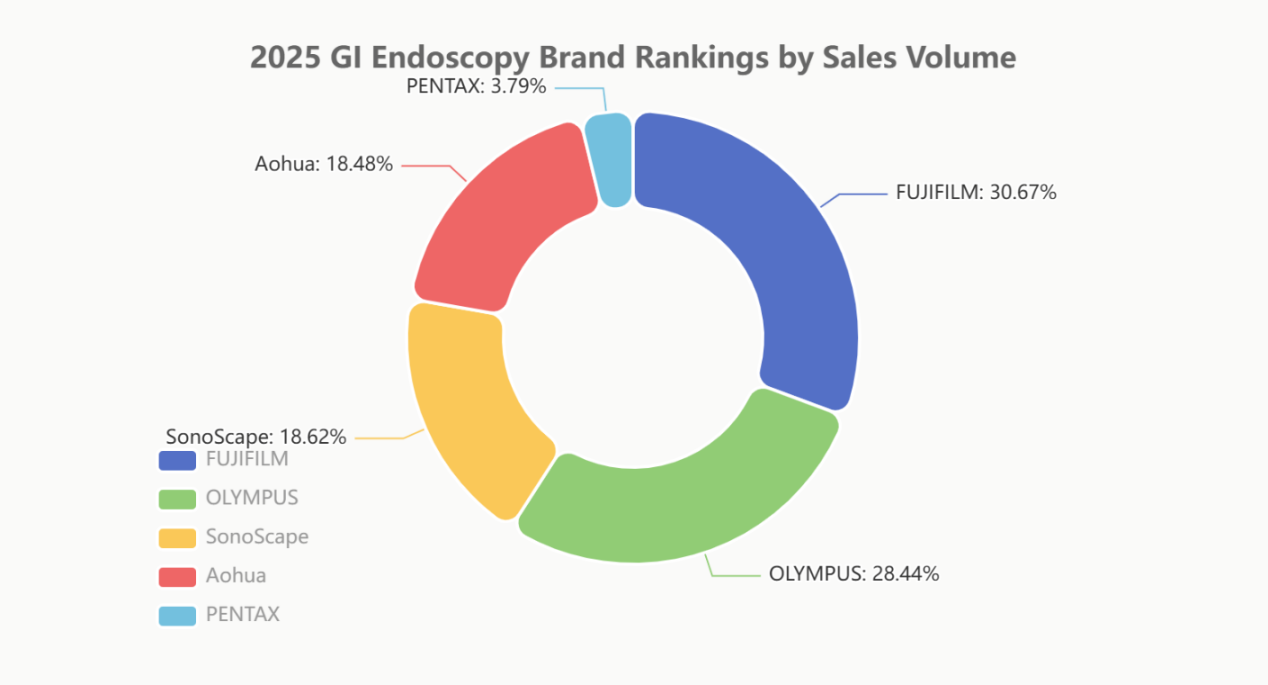

The 2025 brand competition represented a direct confrontation between the two foreign giants and the two leading domestic players. Data from different dimensions reveal the complexity and intensity of this showdown.

Core Report: The Balance of Value and Volume

In the crucial sales value metric, Olympus (35.63%) and Fujifilm (33.56%) remain the absolute dominators, with their combined share nearing 70%, showcasing their formidable moat in the high-end market. Among domestic brands, SonoScape (13.96%) and Aohua (11.41%) firmly hold their positions in the first echelon.

However, shifting the perspective to sales volume, Fujifilm (29.40%) surpassed Olympus (27.26%), indicating Fujifilm’s larger shipment volume in the mid-range market. SonoScape (17.85%) and Aohua (17.72%) maintained similar rankings in volume as in value, reflecting that “exchanging price for volume” remains a primary strategy for domestic brands at this stage.

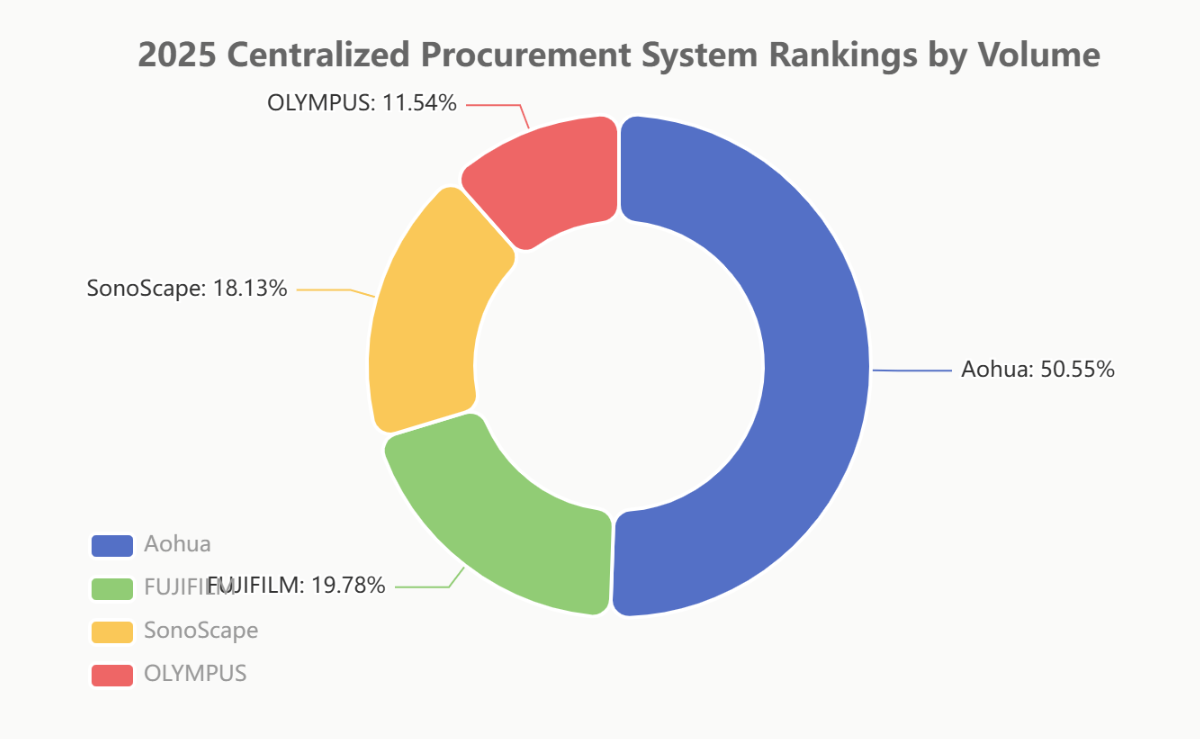

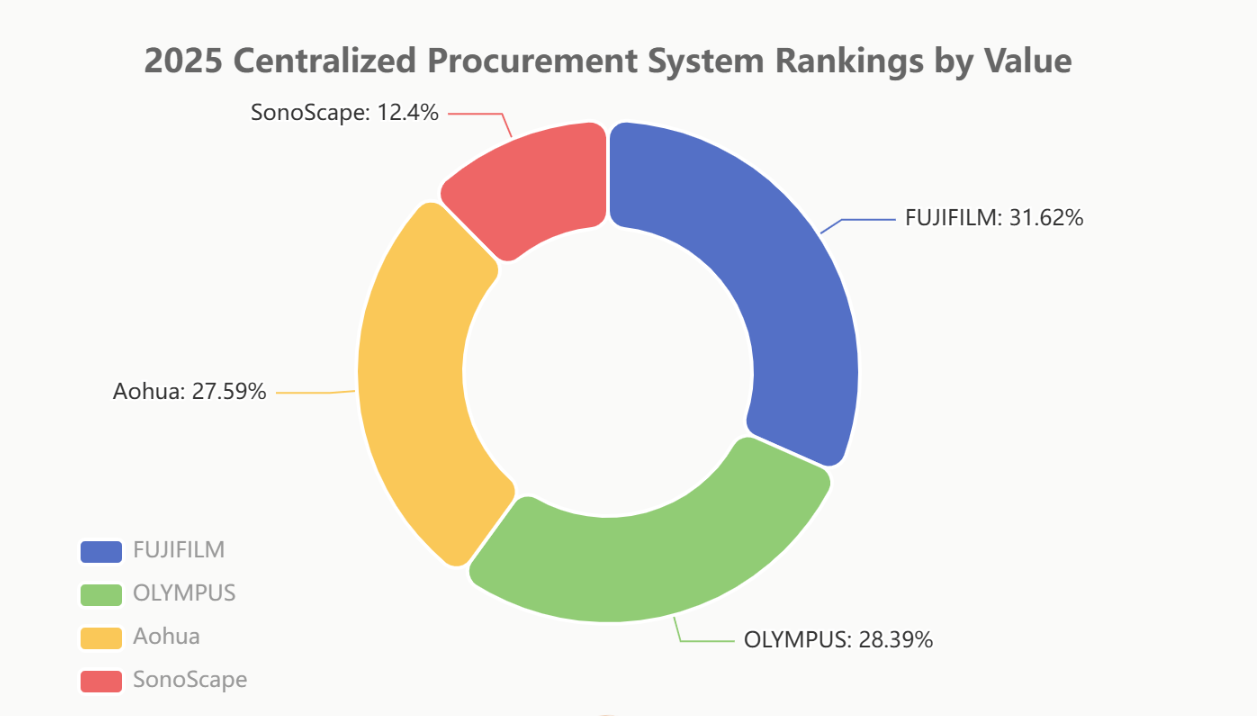

Centralized Procurement Battlefield: The “Home Advantage” of Domestic Power

Centralized procurement (volume-based purchasing) serves as the most authentic “proving ground” for observing domestic substitution.

In centralized procurement volume, Aohua (50.27%) captured half the market with an absolute advantage, emerging as the biggest winner in this arena. This highlights its rapid response to policies and flexible pricing strategies. SonoScape (18.03%) also performed notably well.

In terms of centralized procurement value, Fujifilm (31.48%) and Olympus (28.26%) still led, relying on their high-end product portfolios. However, Aohua (27.47%) followed closely, with a minimal gap, demonstrating that its strategy in centralized procurement is not solely based on low prices; it has also successfully introduced mid-to-high-end products.

III. Rise of New Entrants: Who Will Be the Next “Game Changer”?

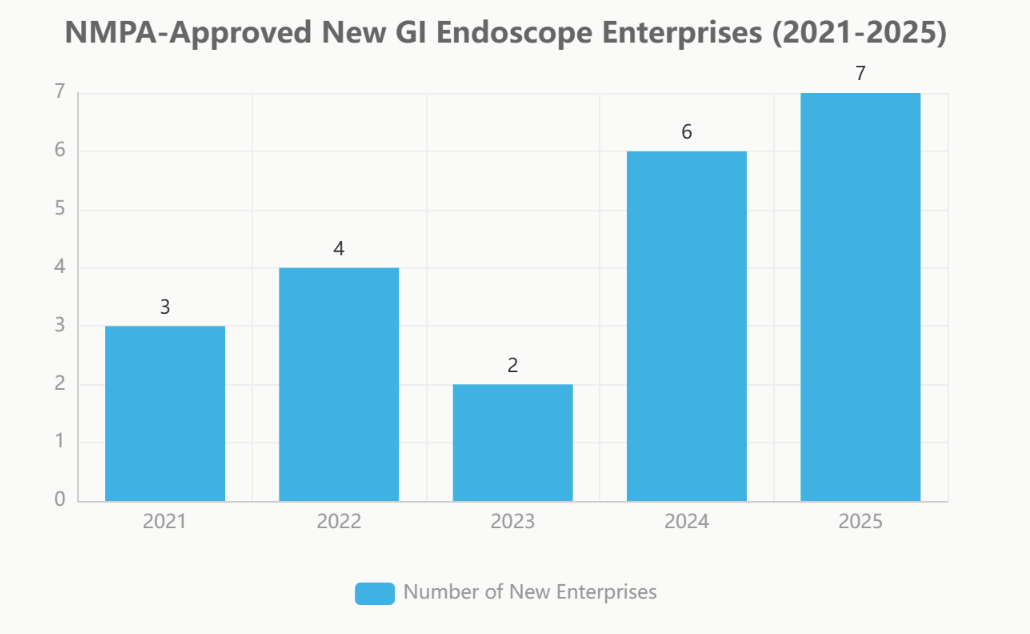

While market giants engage in fierce battles, a cohort of “new entrants” is quietly assembling. Over the past five years, the number of enterprises approved by the NMPA to enter the endoscopy market has increased year by year.

NMPA-Approved New GI Endoscope Enterprises (2021-2025)

|

Year |

Number of New Enterprises |

List of New Enterprises |

|

2025 |

7 |

Cindigo、MicroPort、LONGIN MED、UE、 Medcaptain-Vedkang、Xishan、VINNO |

|

2024 |

6 |

Comen、 United Imaging、Lynmou、JINSHAN、Seesheen 、 Wego |

|

2023 |

2 |

Ruiwo、Lshealthcare |

|

2022 |

4 |

ConceMed、Toooge、Gongjiang、Tonglu Medical |

|

2021 |

3 |

Lepu、Innermed、Siyi |

Accelerated Approvals, New Players Pour In

Starting from 2023, the NMPA’s approval process for endoscopy products has significantly accelerated. In 2025, both the number of new registrations (63) and new enterprises (7) peaked, driven by national policy encouragement for domestic medical devices and fervent pursuit from industrial capital.

“Star Enterprises” Enter the Arena

The list of entrants is illustrious, featuring platform-type medical device giants such as MicroPort, United Imaging, Wego, Lepu Medical, and UE Medical. Their entry, backed by robust R&D, financial strength, and extensive channel capabilities, poses a long-term and profound challenge to the existing market structure.

IV. Finale and Outlook

The 2025 China GI Endoscopy Market is characterized by an intense competition where the “High-End Market Defense War” coexists with the “Mid-to-Low-End & Centralized Procurement Grab War.” Foreign brands defend their high-end market profits with technological and brand advantages. In contrast, domestic brands, riding the tailwind of supportive policies, rapidly expand their volume through centralized procurement and channel penetration into lower-tier markets while actively pushing into the high-end segment.

Looking ahead, with the full-fledged entry of more giants like MicroPort and United Imaging, as well as new contenders like UE Medical, market competition will further intensify. Technological innovation, cost control, and channel depth will jointly determine the ultimate winners of the next round of market reshuffling.

Data Source Note:

The ranking data in this report is produced by Beijing YiBai ZhiHui Data Consulting Co., Ltd., based on what it considers reliable and currently publicly available information.

Data on new enterprises is sourced from Endoscopy Vision flex Industry Notes.

#Gastrointestinal Endoscopy #Medical Devices #Market Analysis #Domestic Substitution

We, Jiangxi Zhuoruihua Medical Instrument Co.,Ltd., is a manufacturer in China specializing in the endoscopic consumables, include GI line such as biopsy forceps, hemoclip, polyp snare, sclerotherapy needle, spray catheter, cytology brushes, guidewire, stone retrieval basket, nasal biliary drainage cathete etc. which are widely used in EMR, ESD, ERCP. And Urology Line, such as ureteral access sheath and ureteral access sheath with suction, disposable Urinary Stone Retrieval Basket, and urology guidewire etc.

Our products are CE certified, and our plants are ISO certified. Our goods have been exported to Europe, North America, Middle East and part of Asia, and widely obtains the customer of the recognition and praise!

Post time: Jan-22-2026